6 Steps to Streamlining Your Retail Payment Process with Mobile Wallets

The modern retail landscape is all about speed and ease for both you and your customers. Mobile wallets have become a game-changer, offering a secure and frictionless way to pay. Mobile wallets aren’t just a trend – they create a faster checkout for your customers and streamline your business operations. Let’s dive into six steps to help you implement and get the most out of mobile wallets in your retail store.

Understanding the Essence of Mobile Wallet Technology

Mobile wallets offer a modern approach to retail payment solutions by securely storing payment information on smartphones, such as credit and debit cards and loyalty programs. This streamlined version of a traditional wallet includes popular options like Apple Pay, Google Pay, and Samsung Pay. Using near-field communication (NFC) technology, these apps enable easy payments with a simple tap of your phone at compatible checkout terminals. They also provide an extra layer of security by requiring authentication methods like fingerprints or facial recognition. As more retailers adopt this technology, the use of mobile wallets continues to grow, enhancing the efficiency and convenience of retail payment solutions.!

Assessing Compatibility and Infrastructure

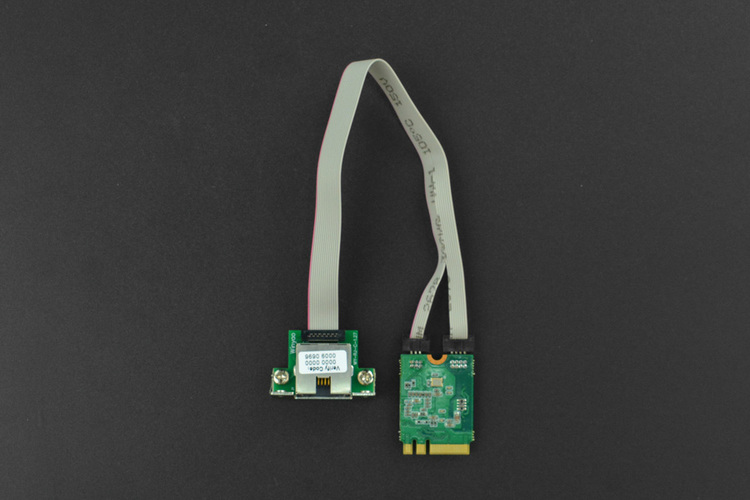

Accepting mobile wallets at your store can streamline your checkout process and attract tech-savvy customers. However, prior to delving into implementation, it’s crucial to ensure that your current equipment meets the required standards. The first thing to check is whether your point-of-sale (POS) terminals have Near Field Communication (NFC) technology. This is what allows customers to tap their phones to pay contactless.

You’ll also want to confirm that your POS system is compatible with the specific mobile wallet platforms you plan to accept, like Apple Pay or Google Pay. If needed, upgrading your POS system might be necessary to accommodate these transactions. While it may seem like an upfront cost, it’s an investment that will pave the way for a smooth and efficient checkout experience for your customers.

Educating Staff and Customers

The key to getting people on board with mobile wallets is making sure everyone feels comfortable using them. This means training your staff to handle mobile payments smoothly and answer customer questions. At the same time, you’ll want to educate your customers about the benefits of mobile wallets, like how convenient and secure they are and how they can even earn rewards.

Clear instructions and signs at checkout can help people who are new to the technology get started and make the switch easily. By informing both staff and customers, you can make mobile wallets a success for everyone.

Prioritizing Security Measures

Ensuring the safety of your funds remains a fundamental concern within the domain of digital transactions. Mobile wallets use advanced scrambling techniques and unique digital tokens to protect your financial information. However, you have the option to incorporate an additional level of security independently.

By using things like fingerprint scanning or PIN codes, it’s much harder for someone else to access your mobile wallet. Also, keeping your phone’s software and your mobile wallet app up-to-date ensures you have the latest security patches to protect against any new threats.

Seamless Integration with Loyalty Programs

Mobile wallets are a game-changer for loyalty programs. Imagine this: you can ditch the bulky cards and easily earn and redeem rewards right at checkout using your phone. No more forgetting your cards or missing out on points!

Businesses can also use your purchase history to offer personalized deals that you’ll actually be interested in. This creates a smoother and more rewarding shopping experience, making you a happy and loyal customer.

Optimizing the Customer Experience

The success of a mobile wallet boils down to how happy it makes users. This involves placing emphasis on crafting a smooth and enjoyable shopping experience from start to finish. Make checking out a breeze by streamlining the process and eliminating any unnecessary steps that add time or frustration.

If something goes wrong, you want to have helpful and responsive customer support ready to assist. By actively listening to your customers’ feedback, you can constantly improve your mobile wallet and ensure it remains a convenient and enjoyable way to pay.

Conclusion

Picture your customers smoothly completing their checkout process with just a tap of their phone, eliminating the hassle of rummaging for cards or cash. This exemplifies the convenience and efficiency facilitated by mobile wallets. They not only enrich the customer experience but also offer a multitude of advantages for your business. From top-notch security to happy, returning shoppers, mobile wallets are a game-changer. By following a few steps to get the most out of this technology, you can simplify your operations and stay on top in today’s competitive market.