Points to consider when comparing small business accounting services

Small businesses & startups often have restricted resources to hire more people. As a small business owner, you cannot escape the need for core employees, but there are tasks that you can outsource to save significant money. Accounting should be on that list. With numerous small business accounting services, how do you compare the options? We have a few pointers for your help.

Look for wholesome expertise

Accounting firms do more than manage your records and accounts. Many of these services have CPAs at the helm, who ensure clients get comprehensive assistance. While looking for choices, ask these questions –

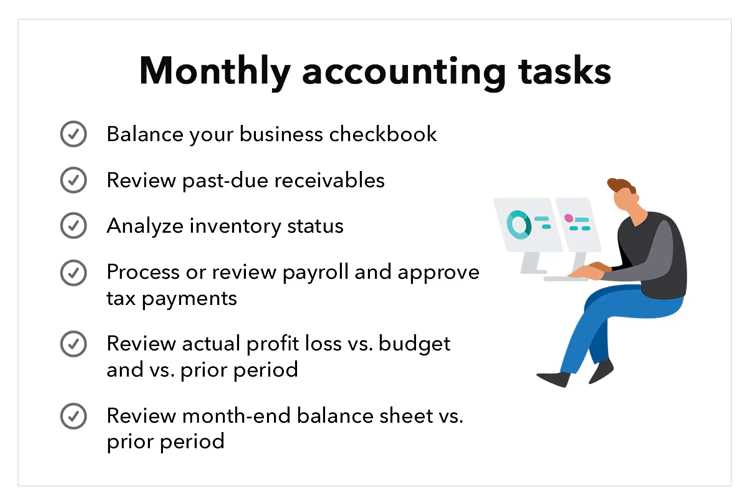

- Can the firm handle my small business payroll needs?

- Do they offer accounting assistance throughout the year?

- Do they specialize in tax planning & preparation?

If a firm can do it all, it is always an advantage because only a particular team is responsible for everything, which means you don’t have to look for separate services.

Consider the expertise in a niche

Not all small businesses are equal, and there are regulations and compliance requirements specific to particular industries. If an accounting firm has worked in your niche and understands the intricacies, you can rely on them to avoid common mistakes and ensure all requirements and standards are met.

Check the pricing module

Accounting firms usually offer flexible packages for small businesses, mainly depending on what they do for clients. For instance, if they are just filing your taxes during the tax season, you will pay a one-time fee. The second option is to have expertise throughout the year, for which you will usually pay a monthly fee. Ensure the pricing is affordable in the long run, considering you will need their support for a long time.

Look at scalability

An accounting firm that can scale as your small business grows should be your first choice. Keep in mind that business accounting and tax work will evolve with time, and if the chosen service can tweak and flex its expertise to cater to specific needs, that is always beneficial.

Final word

If your small business has been struggling with accounting errors or has been late with tax preparation and filing in recent times, these are clear indicators that you need help. Delaying the decision would only mean lacking expertise for a longer time, which can eventually impact the financial health of your company. Make a list of potential firms that can handle tasks remotely when required.