What Are the Different Types of Mortgage Loans Available?

In the expansive landscape of real estate, navigating the realm of mortgage loans can feel like a journey through a labyrinth. Texas residents, eager to embark on homeownership, are met with an array of options tailored to suit diverse needs and preferences. From conventional to government-insured loans, each type presents unique advantages and considerations. Let’s delve into the diverse spectrum of mortgage loans available in the Lone Star State.

Types of Mortgage Loans

Among the different types of mortgage loans that are available on the market include:

1. Conventional Loans

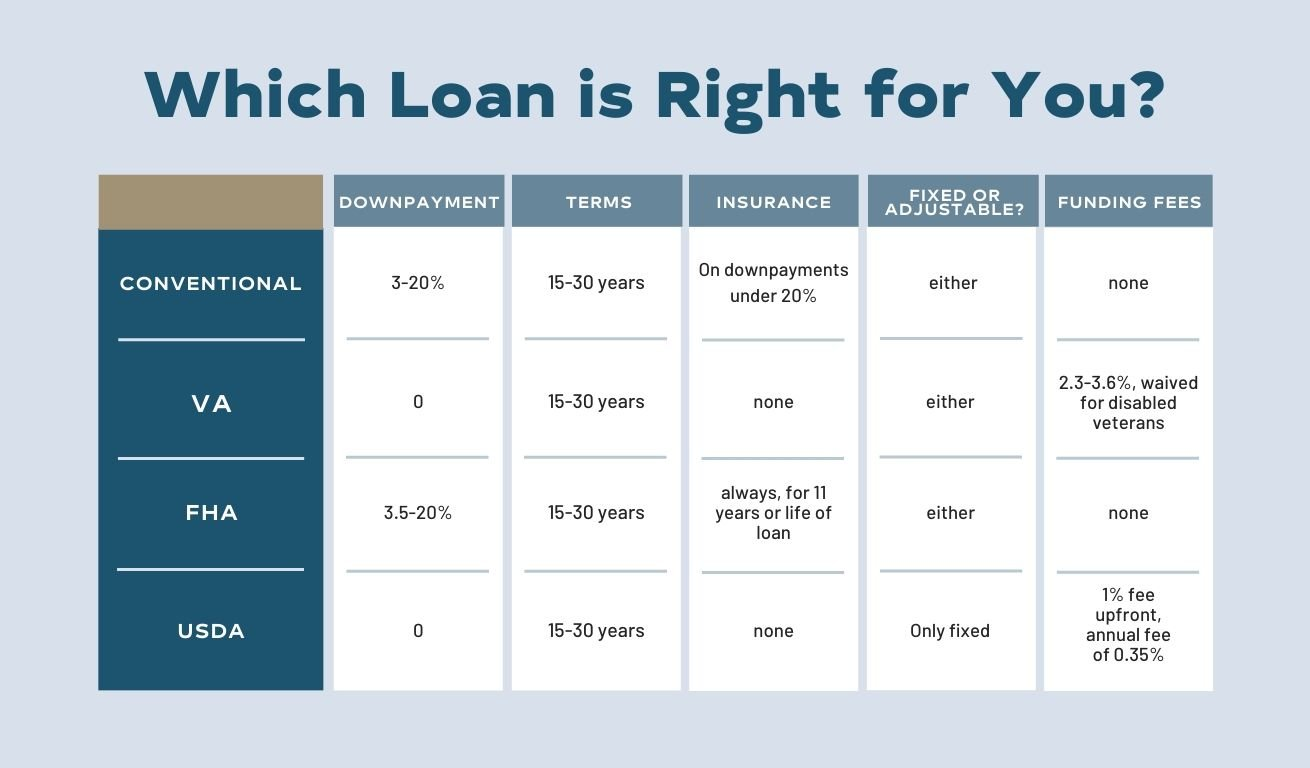

Among the cornerstone options for aspiring homeowners, conventional loans stand as stalwarts in the mortgage market. Offered by private lenders, these loans typically require a solid credit score and a stable financial history. They offer flexibility in terms of down payments, ranging from 3% to 20% or more, allowing borrowers to tailor their investment according to their financial capacity. With fixed or adjustable interest rates, conventional loans provide a predictable path towards homeownership, offering stability and control over long-term finances.

2. FHA Loans

For those seeking a pathway to homeownership with a lower down payment and more flexible credit requirements, Federal Housing Administration (FHA) loans emerge as a beacon of opportunity. Backed by the government, these loans offer accessibility to a broader spectrum of borrowers, including those with less-than-perfect credit scores. With down payments as low as 3.5% and competitive interest rates, FHA loans pave the way for individuals and families to realize their homeownership dreams with relative ease. In Texas, where the real estate market is dynamic and diverse, FHA loans provide an inclusive avenue for entry into homeownership.

3. VA Loans

Honoring the service and sacrifice of military veterans, VA loans serve as a testament to appreciation and support. Exclusive to eligible veterans, active-duty service members, and their families, these loans offer unparalleled benefits, including zero down payment requirements and lenient credit qualifications. In a state like Texas, renowned for its vibrant military community, VA loans serve as a cornerstone of stability and opportunity, empowering veterans to plant roots and thrive in the heart of the Lone Star State. With competitive interest rates and no private mortgage insurance (PMI) requirements, VA loans honor the commitment of those who have served while providing a solid foundation for homeownership.

4. USDA Loans

Nestled amidst the scenic expanse of rural Texas, USDA loans offer a unique opportunity for residents of eligible rural areas to secure affordable financing for homeownership. Backed by the United States Department of Agriculture, these loans feature zero down payment options and competitive interest rates, making them an attractive choice for those seeking tranquility and serenity in rural communities. With a focus on promoting homeownership in underserved areas, USDA loans foster growth and sustainability, empowering individuals and families to thrive amidst the vast expanses of Texas’s countryside. Whether nestled amidst rolling hills or nestled within quaint small towns, USDA loans open doors to homeownership in the heartland of Texas.

How To Get The Best Deal On Mortgage Loans

1. Improve Your Credit Score:

A higher credit score typically leads to better mortgage offers with lower interest rates. Pay bills on time, keep credit card balances low, and avoid opening new accounts before applying for a mortgage.

2. Shop Around for Lenders:

Don’t settle for the first mortgage offer you receive. Explore multiple lenders to compare interest rates, fees, and terms. Online comparison tools can simplify this process.

3. Consider Different Loan Types:

Evaluate various mortgage options, such as conventional, FHA, VA, and USDA loans, based on your financial situation and preferences. Each type may offer different benefits and eligibility requirements.

4. Negotiate Closing Costs:

Closing costs can add thousands of dollars to your mortgage expenses. Negotiate with lenders to reduce or waive certain fees, such as origination fees, appraisal fees, or title insurance.

5. Increase Your Down Payment:

A larger down payment can lower your loan-to-value ratio (LTV), potentially resulting in a lower interest rate and reducing the need for private mortgage insurance (PMI).

6. Lock in Your Interest Rate:

If interest rates are favorable, consider locking in your rate to protect against potential increases during the loan processing period. However, be aware of any associated fees or expiration dates.

7. Review and Improve Your Debt-to-Income Ratio:

Lenders consider your debt-to-income ratio when assessing your loan application. Aim to lower your monthly debt payments or increase your income to improve this ratio and qualify for better loan terms.

8. Seek Pre-Approval:

Getting pre-approved for a mortgage demonstrates to sellers that you’re a serious buyer and can expedite the home buying process. It also gives you a clearer picture of your budget and negotiating power.

9. Consult with a Mortgage Broker or Financial Advisor:

Seeking guidance from professionals can help you navigate the complexities of mortgage loans and ensure you secure the best deal based on your unique financial goals and circumstances.

Wrap Up

In the vast tapestry of mortgage loans available to Texas residents, each option paints a unique portrait of opportunity and possibility. From the stability of conventional loans to the inclusivity of FHA loans, the support of VA loans, and the tranquility of USDA loans, aspiring homeowners are met with a spectrum of choices tailored to their needs and aspirations. As the Lone Star State continues to shine brightly on the horizon of real estate, these diverse mortgage loan options serve as guiding stars, illuminating the path towards homeownership for all who call Texas home.