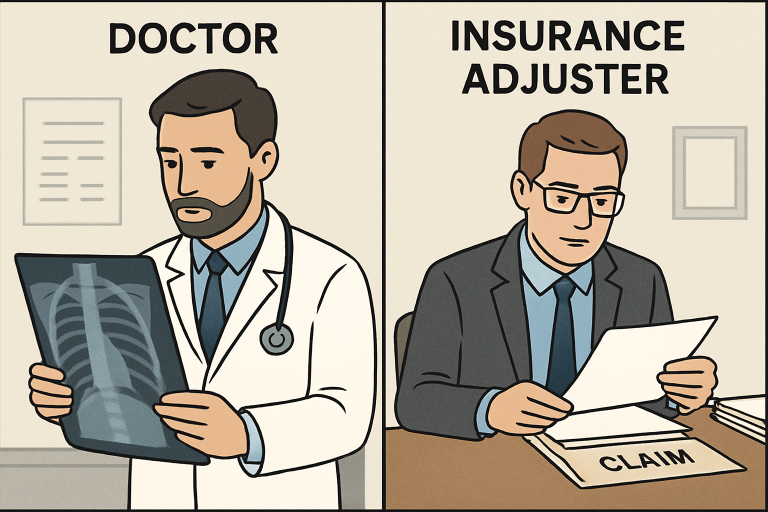

How Doctors and Adjusters See Your Case Differently

Key Takeaways

- Doctors and insurance adjusters view injury claims from very different perspectives: recovery versus cost control.

- Medical records created by your doctor are critical evidence linking your injuries to the incident.

- Insurance adjusters often scrutinize records to minimize or dispute the value of a claim.

- Common insurer tactics include broad record requests, surveillance, and “independent” medical exams.

- Staying informed, limiting information releases, and seeking legal guidance can help protect your claim and your recovery.

Introduction

Navigating an injury claim can feel overwhelming, especially when you’re faced with two key—but very different—perspectives: medical professionals and insurance adjusters. While both play major roles in your recovery process, their approaches and priorities often diverge in ways that can impact the final outcome of your claim. When you’re recovering from an injury and need guidance, consulting with experienced injury lawyers in Cedar Rapids can help you protect your interests at every stage.

Understanding these contrasting viewpoints is essential to ensuring your rights and well-being aren’t overlooked. Medical professionals are dedicated to improving your health and facilitating your recovery, while insurance adjusters focus on the financial implications for their company. Recognizing how each party operates not only helps you advocate for yourself but also lays the groundwork for a smoother claims process.

The Role of Doctors in Injury Cases

Doctors serve as the backbone of your recovery journey. Their responsibilities center on diagnosing your injury, recommending appropriate treatment options, and closely monitoring your progress. These healthcare professionals use objective medical evidence—like imaging, physical examinations, and your reported symptoms—to make evaluations that will shape both your healing and the records submitted in your claim.

In addition to providing treatment, doctors create detailed medical records that chronicle the extent and nature of your injuries. For injury claims, these records can be the most powerful tool you have. They document the full breadth of your symptoms, your pain level, physical limitations, and the healthcare interventions you require. This establishes a clear link between your injury and the event in question.

How Insurance Adjusters Evaluate Claims

Insurance adjusters, in sharp contrast, consider your case through a financial lens. Their main goal is to assess the validity of your claim and determine the insurer’s liability, which often means looking for reasons to minimize the potential payout. Adjusters scrutinize medical records, accident reports, and your personal history not only to verify your injuries but also to identify any inconsistencies or pre-existing conditions that could be used to deny or reduce your claim.

Adjusters operate under strict company protocols and are highly attentive to cost containment. The strategies they use—such as negotiating settlements, interpreting medical opinions, and recommending additional evaluations—are all designed to protect the insurer’s bottom line. Their approach can be vastly different from the empathetic care you receive from your physician, leading to potential conflicts during the litigation or settlement process.

Key Differences in Perspective

- Objective vs. Subjective Assessments: Doctors focus on clinical findings and patient-reported experiences, drawing from medical tests, symptoms, and physical examinations. In contrast, adjusters may treat subjective complaints—especially pain—with greater skepticism, or attribute your condition to unrelated causes.

- Focus on Recovery vs. Cost Containment: Medical professionals aim for your full recovery and may recommend extensive treatments if needed, whereas adjusters examine the necessity of each procedure and push back if they believe something is “excessive” or unwarranted.

- Documentation and Interpretation: A physician’s notes are intended to track patient progress. Adjusters, however, may interpret those same records to cast doubt on the severity or origin of the injury—sometimes misrepresenting what’s written to suit the insurer’s narrative.

Common Tactics Used by Insurance Adjusters

Insurance adjusters rely on a variety of strategies to devalue your injury claim. Awareness of these tactics allows you to counter their efforts and protect your rights:

- Requesting broad medical authorizations that grant access to your entire health history—sometimes to find unrelated past injuries and claim your current symptoms are pre-existing.

- Conducting surveillance or monitoring your online presence for any sign of activity that contradicts your reported injuries, such as social media posts or public events.

- Recommending or insisting upon an examination by an “independent” medical provider, who is often selected and compensated by the insurer, potentially resulting in a biased assessment.

These approaches can be intimidating and may make you question your own credibility, but knowing their purpose empowers you to respond appropriately.

Protecting Your Interests

There are practical steps you can take to safeguard your injury claim and maintain control over your personal information:

- Be cautious with medical authorizations. Only authorize access to records directly related to your accident or injury and never sign broad releases without first consulting a legal professional.

- Exercise discretion on social media. Avoid sharing details or photos that might be misunderstood or used against you in the claims process.

- If you are asked to attend an independent medical examination, discuss this request with your treating physician. Seek legal advice if you have concerns about the validity or necessity of the evaluation.

Staying proactive, informed, and organized not only helps you avoid common pitfalls but also puts you in a better position to secure a fair and accurate assessment of your injury claim.

Final Thoughts

The path from injury to recovery is rarely straightforward, and dealing with the opposing perspectives of doctors and insurance adjusters can be daunting. By understanding the roles and intentions of each party, you can better manage your claim and safeguard your well-being. Always advocate for your own health and rights, supported by trusted medical providers and legal experts when necessary.